Introducing Metia Money Mindstates: How to use the data store to understand your customers’ relationship with money

26 July 2023

Traditional research approaches simply can’t capture the complex and dynamic nature of people’s relationship with money. Metia Insight took a fresh look at the challenge and our Money Mindstates data store is specifically designed to do just that. Accessing the Money Mindstates data store means you will always know exactly what financial consumers are thinking, feeling and doing with their money. Access to always on, AI led data will revolutionize your ability to respond to your customers’ needs, wants and pain points.

A long, long time ago, in a galaxy far far away

When we first meet Hans Solo in Star Wars, he’s in a bar brawl with a debt collector. Cut to the Empire Strikes Back and Jabba the Hutt has him imprisoned over a money dispute. Fast forward to The Force Awakens and we find the Millennium Falcon has been repossessed and our hero smuggling to make ends meet. He might be able to save The Republic but he’s lousy at saving. After 40 years of hard graft, Hans is still in financial firefighting mode.

Leap forward to LA in 1994. There we find Snoop Dog sipping gin and juice, rolling down the street, feeling laid back with his mind on his money, and his money on his mind. Jump to 2023 and he’s worth $160 million and cruising.

Cruising and Firefighting are just two of the six money mindstates our insight team unearthed from our recently launched Money Mindstates datastore.

What is the Money Mindstates data store?

The Money Mindstates data store is a living digital data set built using AI driven data collection scripts and automatically categorizing data by life events, emotions, needs and experiences that are mentioned when people talk about their relationship with money.

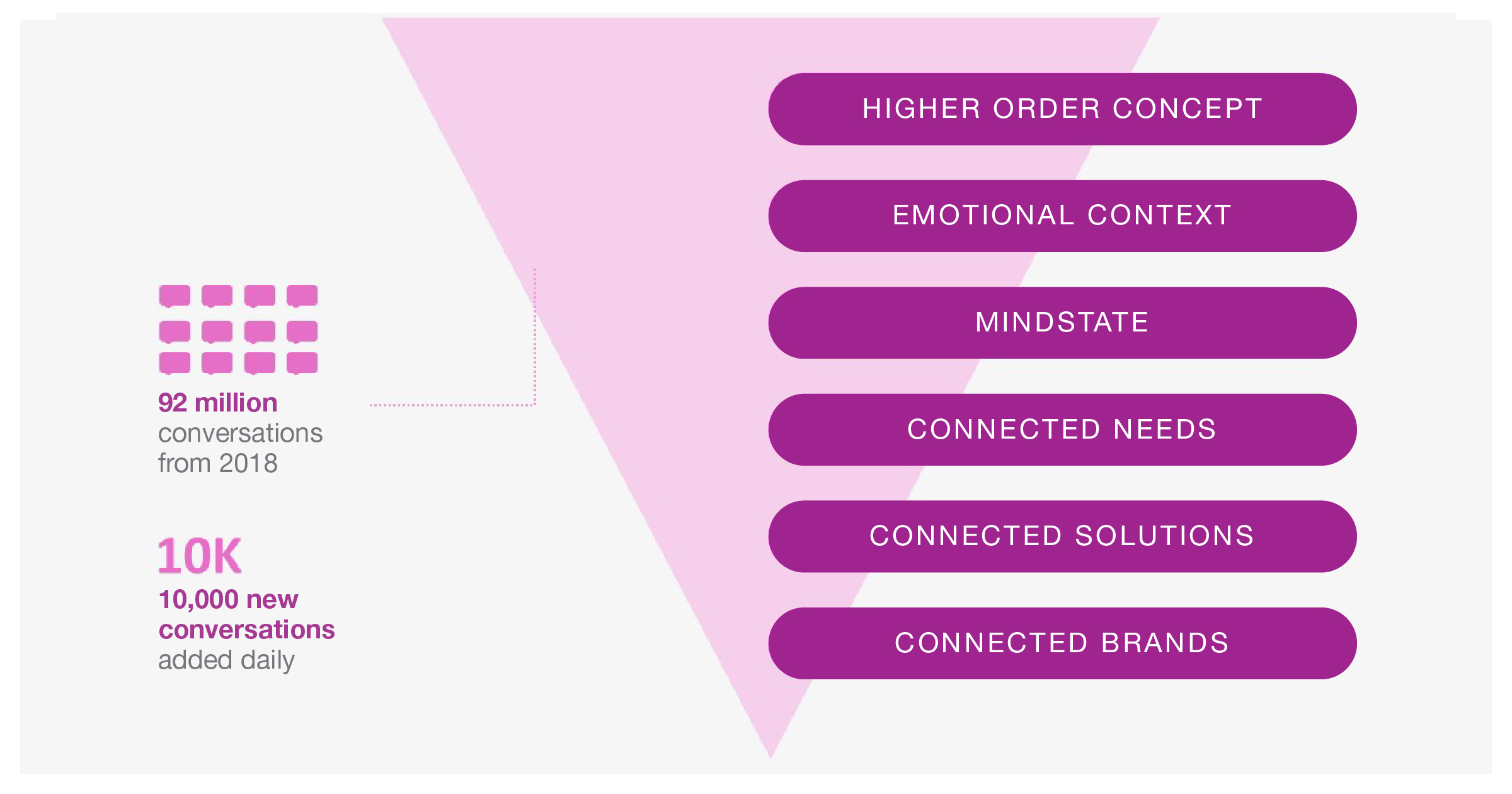

The data store currently contains over 92 million digital conversations curated from over 1 billion different global data sources dating back to January 2018. The data set grows by over 10,000 new conversations daily.

What does it offer you that traditional research can’t?

People can’t always explain why or how they make decisions when they are asked in a questionnaire. It’s hard to effectively recall what they felt or did in the past, and it’s even harder for them to predict definitively how they will behave in the future.

The Money Mindstates data store allows us to truly understand peoples’ relationships with money, because the data is created in context, without any opportunity for people to post-rationalize their responses.

Our data collection and analytics methodologies are based on a combination of AI led search terms, topic modelling, and a selection of other machine learning and natural language processing (NLP) techniques.

This means that we can deliver statistically objective and unbiased insights, rather than human-created assessments, of how peoples’ needs and behaviors change.

How does our analytic approach work?

First, we create and allow our AI engine to iteratively improve search queries in our digital discovery tools until we have a high level of confidence that we are capturing a relevant and representative sample of the online conversations around money.

Our proprietary data analytics platform then breaks the collected parts of the conversation (anything from tweets (x’s) to white papers) into individual words – think about it as converting 92 million conversations into their component elements while retaining the relationships to related words and the context of use.

The system conducts topic modelling using specialized linguistic analysis to review the newly created data set and places them into categories (known as “topics”) based on their appearance in different combinations with other words.

In this first run of the Money Mindstates model, 92 million conversations could be accurately classified into 38 machine generated, meaningful topics.

What questions can the Money Mindstates data store help you to answer?

The data store architecture is designed to create a multi-layered understanding of financial consumers (see below)

Layer 1: The higher order concept

The Money Mindstates data store higher order concept is conversations reflecting peoples’ relationships with money.

Layer 2: Emotional context

Our curated money conversations are then categorized by emotions expressed within the content. This allows us to understand how different emotions are linked to money and how they change based on different life events, experiences, dates, times and seasons etc. This reveals new trends, triggers and emotional connection points to help our clients to build emotionally resonant experiences, offerings, brands, and marketing campaigns.

Layer 3: Money Mindstates

In the initial version of the model, 38 topics were generated and then statistically clustered to form six money mindstates. Each money mindstate represents a different relationship between a person and their money based on the mental energy they apply to successfully navigate the micro and macro environments they find themselves in. The six money mindstates revealed in the initial data model are:

These mindstates are now monitored and continually calibrated to understand how prevalence changes and the triggers which move consumers between them evolve over time.

This data allows our clients to fine tune campaign language, SEO and channel strategy to align with annual, seasonal, monthly and even daily money mindset priorities of financial consumers.

Layer 4,5 and 6: Connected needs, solutions and brands.

Each mindstate is continually interrogated to identify consumers’ unmet needs, emerging trends and demand for financial innovation.

This mindstate can be analyzed by:

- Emotion: 21 emotional states are currently categorized

- Life Event: All major life events that impact finances are currently covered

- Category: e.g., Insurance, banking, pensions and retirement

- By Product: e.g., mortgage, savings account, credit cards

- By Brand: Top 50 financial brands are current categorized

The Metia Insight team will continue to build out categorizations to answer client questions and track emerging trends that are observed in the date.

Who will find the Money Mindstates data store useful?

Banks, wealth managers, pension providers, credit unions and fintechs will find it particularly useful. Brands that offer embedded finance solutions or would like to. Any business that is involved in building products or delivering services will ultimately be consumed by consumers.

If you would like to discuss how to get started with the data, just contact me at Liz.High@metia.com and I will be happy to walk you through the data and insights that are available.