What are the top buy-cycle triggers for technology purchasers in banks?

16 November 2023

As technology purchasers in banks enter their final planning phases for 2024, it’s a good time for fintech marketers to consider the key technology adoption drivers for the year ahead. Through the lens of current technology investment trends and ongoing market dynamics, 2024 offers many opportunities.

Banks’ spend on tech continues to grow

According to Gartner, the total IT spend for banking and investment services firms was set to reach $651 billion in 2023—an increase of 8.1% from 2022. Software (do we still call it that?) was expected to see the largest growth, increasing by 13.5%.

There are many drivers for the relentless increase in tech spend among banks. Now, more than ever, agility is crucial as regulatory and wider macro-economic factors, such as sustained inflation and rising interest rates, continue to disrupt. Despite this and even following the collapse of Silicon Valley Bank and others earlier in 2023, there is still a commitment from banks to increase technology spending.

Price sensitivity is reduced

While the expense of working with fintech vendors was called out as a concern, our research revealed that the cost of technology is still of less importance to business decision makers (BDMs) in banks than it is for their counterparts in other industries.

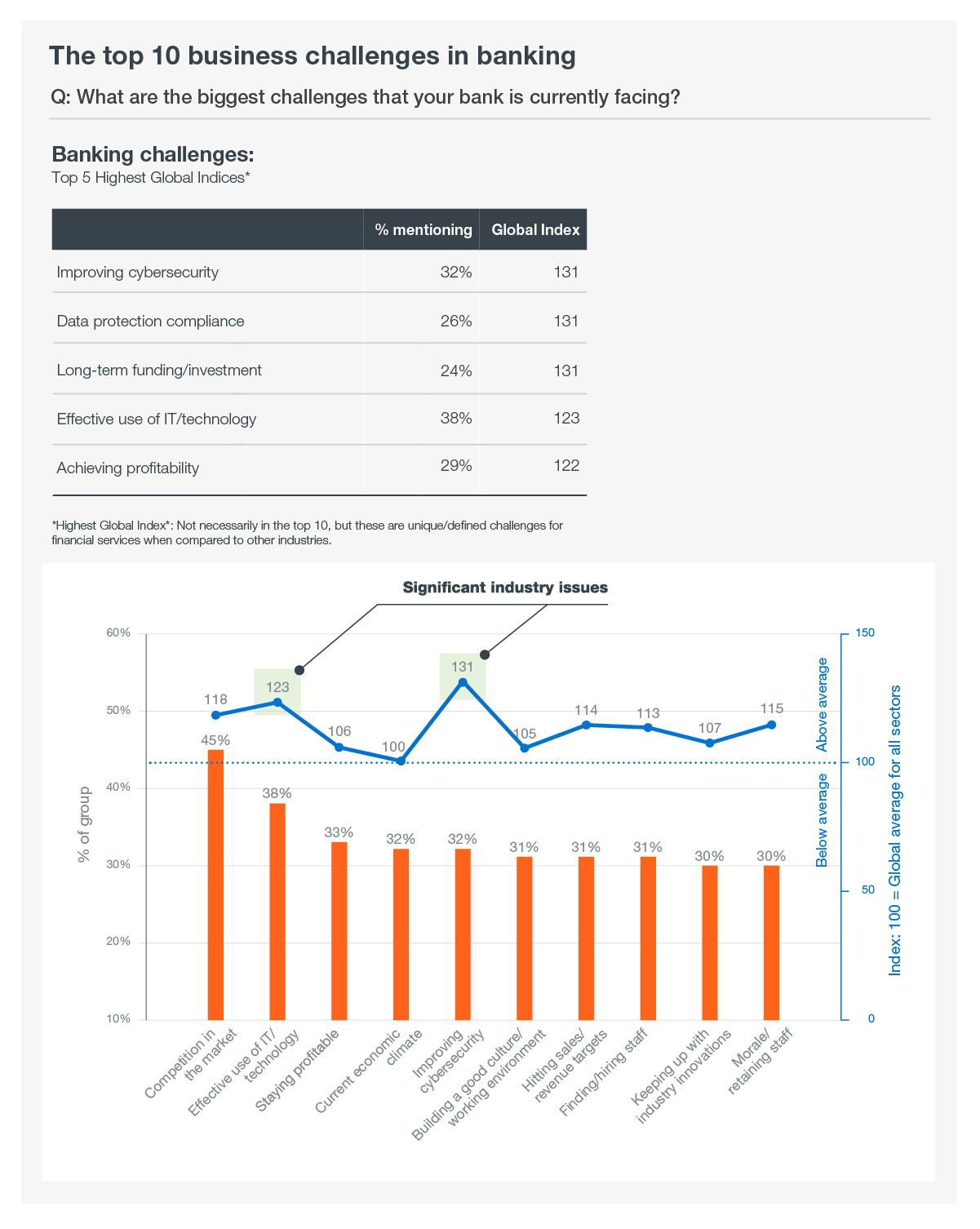

According to our research report, ‘The State of the B2B Financial Technology Buy-cycle 2023’, ensuring technology infrastructure is agile and enables banks to remain competitive is a key driver for BDMs, with specific challenges highlighted around optimising technology investments. The top three current growth initiatives in banking focus on enhancing security, improving differentiation against competitors and ensuring faster reactions to industry changes. This is reflected in the responses from senior BDMs, who highlight cybersecurity, data protection and compliance as key business challenges.

Opportunities for security and data partners

Vendors with robust data and security offerings will clearly appeal in 2024, as will regtech and compliance solutions. When asked about their organisation’s biggest challenges, senior BDMs highlighted government regulations, legal requirements, bureaucracy, and increased responsibilities around data protection and compliance as significant issues.

Often, enabling agility is at its core a data issue, as new data regulations and industry standards force organisations to quickly redirect digital transformation efforts towards evolving their data strategy. Vendors with offerings that advance data management, security and governance processes will be particularly attractive to BDMs, as a more agile data infrastructure enables regulatory frameworks to be built-in, ensuring operationalised data is compliant-by-default.

Listen and stay close to your networks

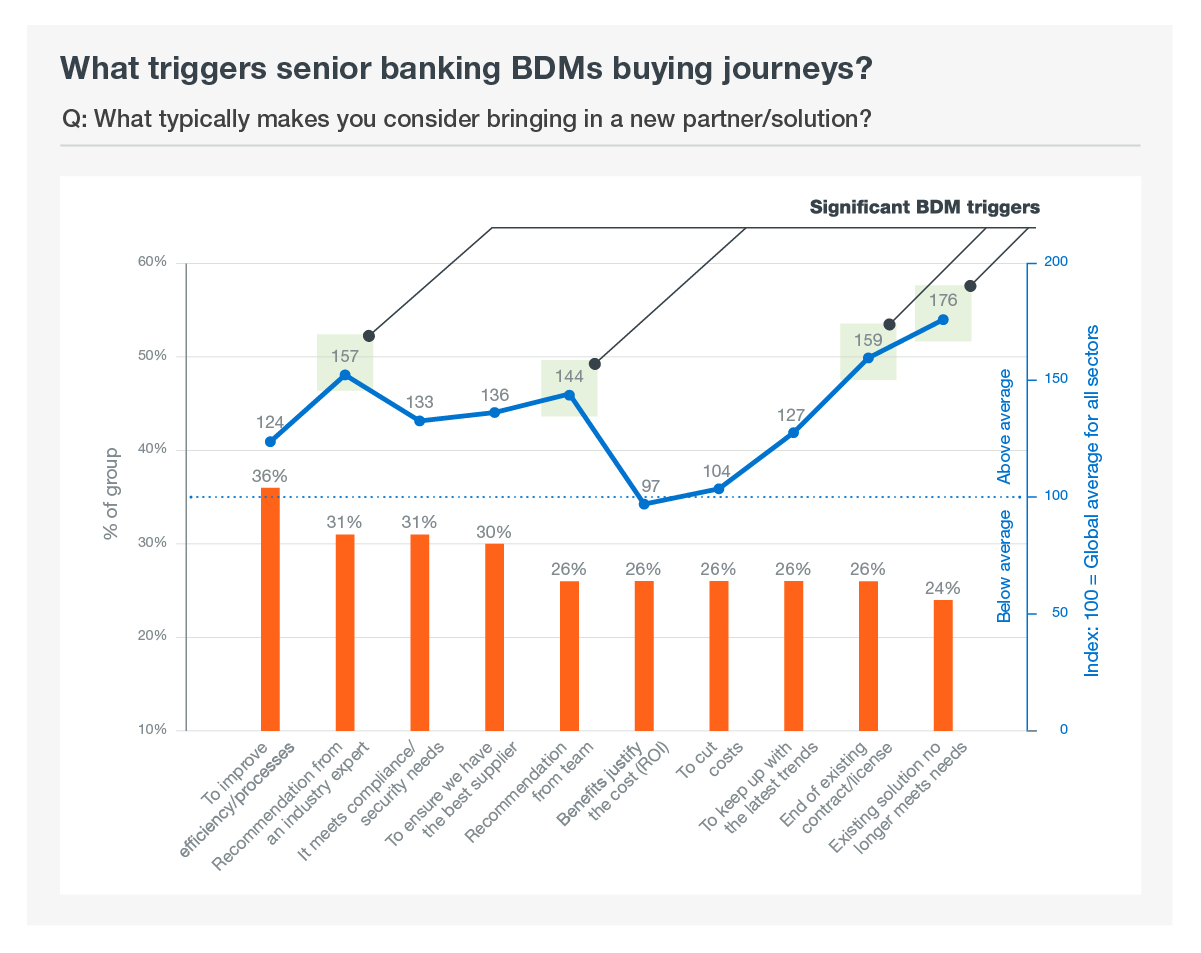

While these insights highlight crucial factors that should inform any fintech marketer’s strategy, it’s also important to be aware of the more mechanical drivers of technology adoption. For example, contracts with existing suppliers coming to an end are a significant catalyst for BDMs to consider bringing in a new partner or fresh solution. Keeping track of previous bids and driving re-engagement and reactivation activities close to the end of contracts is certain to attract the attention of BDMs as they assess the value of existing partnerships.

The need to replace, update or augment current systems, particularly when an existing solution no longer meets needs, are also top buying cycle triggers. This highlights the importance for fintech marketers of ensuring ongoing engagement across all the channels which more senior BDMs frequent (more on this is a follow up post) with consistent messaging that tracks against these issues.

Showing how quickly and seamlessly a solution can be implemented and integrated, with minimal disruption to customers and users, is crucial for illustrating both the immediate and long-term benefits of any fintech’s offering.

Cloud integration is a powerful driver

We know that banks have been slow to fully embrace the cloud, but IBM’s State of Cloud, 2022 report revealed that 71% of financial services organisations recognise that achieving the full potential of digital transformation is difficult without a solid cloud strategy in place.

SaaS, PaaS and IaaS offerings have been gaining traction in financial services for some time and offer banks the chance to quickly innovate around their legacy systems. Fintechs that deliver these services, and can show how their technology integrates with existing systems—with minimal disruption—will likely rise above their peers and into the line of sight of BDMs, who are acutely aware of the imperative to drive efficiency and improve processes, while maintaining day-to-day operations.

Senior bank BDMs will only follow technology adoption roadmaps with concrete business objectives at their core. These objectives have been defined against the backdrop of the challenges outlined above, but simply covering them off is not enough when it comes to communicating the value of a fintech partnership or solution. BDMs have wider organisational objectives to consider when making a purchase, which touch upon wider brand narratives, including DEI and ESG objectives, and their own perception of what bolsters their organisation’s reputation.

These factors will be covered in the next post, in which we examine the top purchase drivers for BDMs.

The State of the B2B Financial Technology Buy-cycle 2023: can be downloaded here.